There has been a lot of discussion over kitchen tables and online about the Tax Increment Financing District (TIF).

A significant amount of this discussion is based on a misunderstanding of what a TIF does and why we

really need it. There will be a TIF public hearing on April 15th. The Village Trustees will vote on implementing the TIF on April 29th.

The TIF is not a new concept and has been in place in Illinois for almost 50 years. But it is new to St. Joseph so there are naturally lots of questions and fear of the unknown. Complicating this process are online discussions that are often full of misinformation – or in some cases with the intent to defeat its implementation. I feel like it is important for the residents to hear from the incoming Village President about this issue.

The TIF requires a deep look and examination and that is what this document is about. I am sorry that it is four pages long but bear with me. I assure you that when you are done reading it, you will have a wider perspective.

Before the election, I promised that I was going to be forthcoming, informative, and honest – an open book about where I am on the issues. I knew there would be divisive topics, and the first one up is the TIF. The bottom line is that I am in support of it and here is why.

No Increase in Property Taxes

The TIF will not raise property owners’ taxes. The TIF changes what the local taxing bodies receive from inside the TIF district. A portion of the property tax inside the TIF district will be combined, set aside, and used as an economic tool with the purpose of fostering economic growth.

Apparent Loss of Tax Revenue

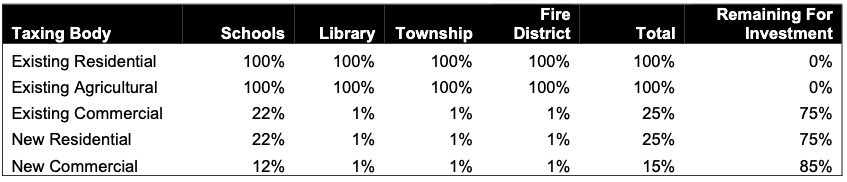

There have been allegations that the fire, township, school districts and/or the library will “lose” money if the TIF passes. That is a matter of the semantics of the word “lose.” For instance, these taxing authorities will not technically lose anything on the current residential housing from what they have now. However, they WILL receive a lower percentage of taxes on new residential growth. Additionally, they will receive a lower percentage of the growth of the current commercial properties inside the TIF. They will not lose it ALL and will retain a percentage of that tax revenue. Keep in mind also, that this also applies to the Village itself which will lose some tax revenues just like the schools, the fire district, and the township/library. That money will be combined with the others to create the TIF fund.

The table above shows a simple breakdown of the proposed split.

To be clear, the Village has the legal authority to implement a TIF on its own and not share any percentage.

However, to its credit, the Village has consulted with representatives of local jurisdictions prior to

implementation. Modified tax revenue sharing offers are on the table and represented in proposed

intergovernmental agreements.

It is understandable that the other taxing bodies are concerned that increased development will put a burden on them that will stress their budget because they are not getting all the tax revenue from increased growth in the TIF district. However, this growth will not be immediate and will be spread out over time. In the first few years, I believe that it would not be a financial deal breaker for any of those jurisdictions. However, as time passes and development in the TIF district grows, that financial need will be felt more keenly. That is when funds from the TIF can be shared with the schools, fire, and township/library under certain circumstances to offset some of the loss of revenue.

Keep in mind that St. Joseph needs commercial growth as well. However, businesses are not likely to come to towns like St. Joseph where the population is dropping. If we can turn that curve around (which I intend to prioritize), it will be easier to bring commercial growth to St. Joseph. Some of that growth will NOT be in the TIF district. I believe that the TIF will spur an increase in population which will make St. Joseph more attractive for potential commercial growth. The other taxing bodies will benefit from new property taxes on new commercial development outside the TIF district as soon as they are developed.

TIF Restrictions

Funds placed in the TIF account are legally restricted for very specific things. Online comments with

accusations like, “the village is lining their own pockets” or “padding their budget” are untrue, uninformed, and not helpful. TIF funds can only be used inside the TIF for efforts related to or supporting any of the following activities:

Property Acquisition, Renovation, and/or Rehabilitation

Public Works and Infrastructure Improvements in the TIF

Job Training and Relocation

Financing Costs

Studies, Surveys and Planning Costs

Demolition and Site Preparation

Cleaning up Polluted Areas

Improving Downtown Business Districts

Developing Sites for New Commercial Use

Rehabilitating Historic Properties

These funds will be sequestered, not mixed with Village money, audited and expenditures will be strictly controlled by law.

The TIF is limited to being an economic development tool, targeting investments and focusing on redevelopment.

TIFs Are Common

A bit of research reveals that in East Central Illinois, the following cities have current TIF districts:

Fisher: 5 Tilton: 5 Arcola: 5 Champaign: 3 Rantoul: 3 Hoopeston: 3 Tuscola: 3 Paris: 2 Gibson City: 2 Oakwood: 2 Urbana: 2 Mahomet: 2 Savoy: 2 Rossville: 2 Tolono: 1 Homer: 1 Bismark:1 Danville: 1 Georgetown: 1 Monticello: 1 Cerro Gordo: 1 Villa Grove: 1 Paxton: 1 Farmer City: 1 Clinton: 1

While it is new to us, what St. Joseph is doing is quite common throughout Illinois. There are 1,500 TIF districts in five hundred municipalities across Illinois. Four out of every ten cities in Illinois utilize TIFs.

TIF Effects

Some have asked if TIFs are successful. Ask yourself this question, “If the TIF is such a bad economic deal as some people are saying, why do so many municipalities adopt and grow TIFs as an economic strategy?” The answer is because it works. Look at cities like Fisher, Tilton, Arcola, and Tuscola that kept adding TIF districts as time progresses. It is not because TIFs are bad policy, it is because they are generally successful. I would also like to point out that the responsibility of economic growth is that of the Village of St. Joseph. It is not in the purview of the library, fire, or schools. They are all contributing factors for economic growth, but the actual responsibility to make it happen falls to the Village.

For one example of a successful TIF, see this article.

Due to new housing supported by its TIFs, Fisher has experienced an increase in its population and

residential/commercial growth. On the other hand, St. Joseph has seen a 4% population drop from 2010 to 2020 and speculation is that it has continued to drop since then. Our school enrollment has dropped 150+children over the last several years.

Many folks do not know that the Village receives most of its funding from the State in programs such as the Local Government Distribution Fund (LGDF) and Motor Fuel Tax (MFT). St. Joseph gets more than twice as much from those State payments than it does from property taxes. LGDF and MFT funds pay for roads repairs and keep the Village operating. Both of those funds are distributed based on per capita population. As our population decreases, so do our State funds. Combine that with inflation and you can imagine where it leads.

St. Joseph’s population drop can be attributed to several factors. I believe the biggest factor is that 20-30 years ago approximately five hundred homes were built in Crestwood and Crestlake subdivisions which were priced for young families like mine at the time. In those years, we raised our children who have grown up and moved away. Our household of five is now a household of two. This is also partially the cause of the school’s drop in enrollment as well. Because we do not want to move from St. Joseph – coupled with no new homes or senior living accommodations being built as options – our population continues to fall.

No new houses have been added in years because there is a financial disconnect between what developers can afford to build and the current cost of the surrounding land. The Village can use the TIF funds to close that gap to initiate development by supplementing infrastructure costs. For instance, TIF funds can finance the installation of sanitary and storm sewer lines or lift stations, thereby making the financing for developers more feasible. What the TIF helps us do is to increase the tax base so that we are not just taxing the ever-shrinking base even more. Growing the pie instead of increasing property tax which could lead to a “doom loop” of stagnation. In the long run, the TIF will help the schools, the fire district, and the library.

TIF Initiates Growth

ST. JOSEPH NEEDS GROWTH. I am not talking crazy fast or unplanned, mismanaged growth. Like many have said, “I don’t want us to be Mahomet.” Neither do I. However, I am in support of modest consistent growth of both residential and commercial. Based on my online survey last fall, so do most of the St. Joseph area residents. Of the 160 respondents, 91% indicated they wanted more commercial growth and 66% said they wanted more residential growth.

Everyone knows and feels that inflation is an issue. Inflation has increased 26% over the last five years. That means a unit of concrete that used to cost $1,000, now costs $1,260. A $20/hour wage is now $25/hour. Streets, sidewalks, storm sewers – all the things that the resident rightfully expect the Village to maintain, build and repair – all cost 26% more than they did since just before COVID. Without an increase in the tax base, we can only do 75% of what you expect the Village to do. The TIF will promote growth, which will increase the amount of both property and sales taxes paid; hopefully making up for this shortfall. I think our residents would rather that be the solution instead of increasing property tax rates outright – to which I am opposed.

Please note that there are some developers that are waiting to see what St. Joseph does regarding the TIF. If it is adopted, they will be more likely to engage the Village to reach a deal to start building. Also note that a side benefit of additional residential growth is the lessening of the sanitary sewer financing burden for current residents.

Conclusion

I understand the concern of the other taxing bodies entirely. If I were a school, library, fire, or township board member, I would be apprehensive too. However, I believe there is a bigger issue at work here. When the TIF was first proposed in 2017, the same objections were made by the same taxing bodies as are being made now so the Village voted down the proposal. That strategy failed. We are now eight years later and still have had NO growth. In fact, we are shrinking. The Village has tried to bring development to town, but the competition with other towns with TIF incentives is too much. Without TIF incentives, many developers will not even talk to the Village. It is time for us to face the situation and bring all the tools we have to bear and turn the school enrollment and population decline downward trend around.

If we do not, we will soon experience even bigger problems. Without more homes, living options and

commercial growth, St. Joseph will start to economically deteriorate. Developers and builders must make a profit, so they go to other towns – like Fisher – and benefit from their TIFs.

Every policy has upsides and downsides. From my perspective, the bottom line is that there are many benefits to implementing a TIF that outweigh the downsides. I also believe that many folks are feeling a natural fear of the unknown. St. Joe must grow, and the TIF is the most efficient and commonly used tool to do just that.

I also commit to the schools, fire district, township, and the library that under my watch, the Village will work with them to overcome any reasonable hurdles that we all face in the next four years. Let’s roll up our sleeves and get to work together to stop the stagnation, begin some modest growth and keep St. Joseph affordable and the town we love.

Thank you for your time and consideration.

Jim Page

You must be logged in to post a comment.