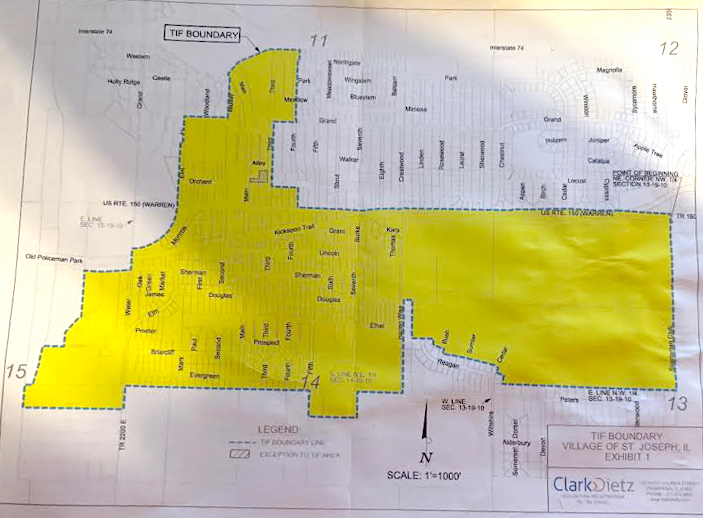

The Village of St. Joseph is moving forward with the process to form a TIF District.

Tonight at 7 p.m., before the regularly scheduled meeting, the village will hold the first of several public meetings on the issue.

For more on TIF Districts visit here.

A TIF District is a Tax Increment Financing District.

“The board gave me a clear directive to work with the other taxing bodies, specifically the schools, to make sure if we do a residential component, they are comfortable with it,” said Village Administrator Joe Hackney.

Why do a TIF

Hackney said the village needs to do a TIF District for to jump start development. Hackney said school enrollment is down, with schools losing 12 students a year, and the village’s population has declined.

“You have a house with five people in it, kids move out, the house turns into a two person house hold because they don’t want to leave St. Joseph,” Hackney said. “Common sense tells you the population will go down.”

Hackney said the village has a lot to offer residents, however, housing options are limited with a small number of duplexes and smaller scale houses unavailable.

Hackney said that while demand is high for houses in St. Joseph, developers are having a hard time finding land to build houses on.

“Developers have math they have to do to see if it would make sense for them to do this,” he said. “We are seeing $10-15,000 gaps from the farm land owners. If they are going to build 70 houses for example they have to make a return and make a profit.”

Hackney said since the village hasn’t had a large amount of residential growth since 2012, developers are hesitant to build here.

“In another area town there is momentum, they know the subdivision will sell,” Hackney said.

Another issue is that farm land in this area comes at a premium cost. Hackney said there is a “gap” between what land owners want for their land and what developers are willing to pay.

“It’s just a gap that keeps occurring,” he said. “A TIF is designed to provided local governments a bridge for that gap.”

Hackney said the village is looking at a commercial and residential TIF to create development in both sectors. The village is looking at a TIF that Hackney characterizes as small for the residential portion because of how friendly the TIF is to the other taxing bodies.

In a traditional TIF the village would keep the majority of new property taxes from new development.

“A local taxing body friendly TIF is better than no TIF at all,” Hackney said. “We would rather have a TIF. Our whole point is we have to be partners and live with them. We want them to be supported. As goes the school, as goes the fire district, the library, the township, goes the village.”

Hackney said that the village hears all the time that they need more commercial development.

“We totally agree,” he said.

The commercial TIF will focus on Route 150 and Interstate 74.

“We want to take advantage of I-74 so people driving from Peoria to Cincinnati want to stop and spend sales tax money,” he said. “The more people you pull off the interstate to pay, the less the population has to pay for infrastructure.”

The village has taken on several infrastructure upgrades recently including upgrading the sewer plant and the sewer trunk line as well as a drainage project on the west side of town.

The village has paid for those upgrades.

“It’s a lot of money,” Hackney said. “It’s very expensive. We have taken on a fair amount of infrastructure improvements and we need to have a certain level of growth to continue to do that. If you have growth, you have more people paying for things. Growth isn’t just a nice thing to have, it is critical for us. If we didn’t have a single sewer user added over the next 20 years we could cover it but it is snug for us.”

What it means for other taxing bodies

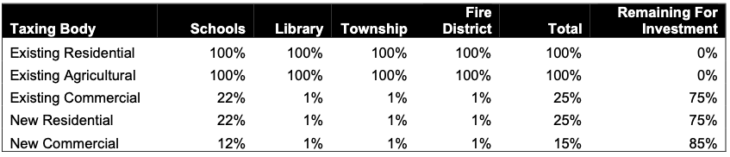

Whenever the TIF is established, the Equalized Assessed Value is established and frozen.

The taxing districts will receive all the property taxes that they currently receive from existing residential.

The property taxes from new residential construction will be divided between the taxing bodies and a TIF Fund. The fund can be used to make improvements within the district by the village. They can also reimburse businesses or developers with money from the fund.

From new residential development the school district combined will get 45 percent of their tax dollars reimbursed. The remaining taxing bodies will get 1 percent each. What remains will go into the TIF fund.

“You will be hard pressed to find another municipality willing to do that,” Hackney said.

For new commercial development, all four taxing bodies will receive 1 percent of the new property tax dollars, with 96 percent going back to the TIF fund.

“The 96 percent available gives us the ability to invest within the district,” Hackney said.

Existing commercial will be broken down into 40 percent for the schools and 1 percent for the other taxing bodies with 57 percent remaining for the TIF fund.

What’s different this time

Hackney stressed that with this proposed TIF District there was no developer pushing the project.

“We wanted this to be a local taxing body led initiative,” Hackney said. “We didn’t want the perception to be that there was a developer out there that was pulling the strings. We wanted this to be created through a collection of conversations with local taxing bodies. It is only the public bodies that structured this thing. While there is no approved projects at this point but the parameters are established and set for them.”

He also stressed that a TIF doesn’t create new taxes, it is simply a tool to entice developers to St. Joseph.

“You won’t notice anything different on your tax bill because of this,” he said.

Other towns

Hackney said St. Joseph is one of the only towns in the area without a TIF and developers often ask what type of incentives the village has. Hackney said the village is in competition with Mahomet, Savoy and Tolono for development.

“My opinion is that St. Joseph has just as much, if not more, to offer than the other municipalities,” he said. “It’s an easy drive, you can feel safe with your kids walking down the sidewalk, it’s laid back. We offer all those things. The elected officials all want to place a high focus on keeping St. Joseph a family friendly place.”

You must be logged in to post a comment.